Other Uses

Financial Services

According to Reason, many banks have expressed interest in implementing distributed ledgers for use in banking and are cooperating with companies creating private blockchains, and according to a September 2016 IBM study, this is occurring faster than expected.

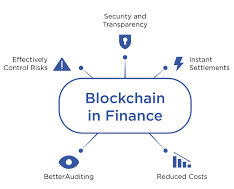

Banks are interested in this technology not least because it has the potential to speed up back office settlement systems. Moreover, as the blockchain industry has reached early maturity institutional appreciation has grown that it is, practically speaking, the infrastructure of a whole new financial industry, with all the implications which that entails.

Banks such as UBS are opening new research labs dedicated to blockchain technology in order to explore how blockchain can be used in financial services to increase efficiency and reduce costs.

Berenberg, a German bank, believes that blockchain is an “overhyped technology” that has had a large number of “proofs of concept”, but still has major challenges, and very few success stories.

The blockchain has also given rise to initial coin offerings (ICOs) as well as a new category of digital asset called security token offerings (STOs), also sometimes referred to as digital security offerings (DSOs). STO/DSOs may be conducted privately or on public, regulated stock exchange and are used to tokenize traditional assets such as company shares as well as more innovative ones like intellectual property, real estate, art, or individual products. A number of companies are active in this space providing services for compliant tokenization, private STOs, and public STOs.

Energy Consumption Concerns

Some cryptocurrencies use blockchain mining — the peer-to-peer computer computations by which transactions are validated and verified. This requires a large amount of energy. In June 2018 the Bank for International Settlements criticized the use of public proof-of-work blockchains for their high energy consumption. Early concern over the high energy consumption was a factor in later blockchains such as Cardano (2017), Solana (2020) and Polkadot (2020) adopting the less energy-intensive proof-ofstake model. Researchers have estimated that Bitcoin consumes 100,000 times as much energy as proofof-stake networks. In 2021, a study by Cambridge University determined that Bitcoin (at 121 terawatt hours per year) used more electricity than Argentina (at 121TWh) and the Netherlands (109TWh). According to Digiconomist, one bitcoin transaction required 708 kilowatt-hours of electrical energy, the amount an average U.S. household consumed in 24 days In February 2021, U.S. Treasury secretary Janet Yellen called Bitcoin “an extremely inefficient way to conduct transactions”, saying “the amount of energy consumed in processing those transactions is staggering”. In March 2021, Bill Gates stated that “Bitcoin uses more electricity per transaction than any other method known to mankind”, adding “It’s not a great climate thing.” Nicholas Weaver, of the International Computer Science Institute at the University of California, Berkeley, examined blockchain’s online security, and the energy efficiency of proof-of-work public blockchains, and in both cases found it grossly inadequate. The 31TWh-45TWh of electricity used for bitcoin in 2018 produced 17-23 million tonnes of CO2. By 2022, the University of Cambridge and Digiconomist estimated that the two largest proof-of-work blockchains, Bitcoin and Ethereum, together used twice as much electricity in one year as the whole of Sweden, leading to the release of up to 120 million tonnes of CO2 each year. Some cryptocurrency developers are considering moving from the proof-of-work model to the proof-of-stake model.