Natural Language Processing in Finance

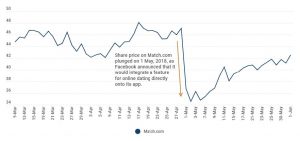

On 1 May 2018, Facebook’s CEO Mark Zuckerberg said, “We want Facebook to be somewhere where you can start meaningful relationships,” he continued. “We’ve designed this with privacy and safety in mind from the beginning.” at an annual developer conference. The announcement elicited gasps not only from the audience in front of Zuckerberg but also from financial markets. Match Group (the firm that owns Match.com, Tinder, and other online dating sites) saw its stock price plummet by more than 20%. As it can be from Mark Zuckerberg’s example, the financial markets can be fluctuated by a sentence. This financial behavior which strong financial reaction by a few words, happens all the time, and Natural Language Processing is used by financial companies and traders to detect them before the reaction. In this post, we will focus on using NLP in finance.

Detecting Material Events

NLP is efficient in uncover market-moving events. Lots of market-moving events occur in the financial markets. Text and spoken words are primary sources for lots of the events. NLP approaches are used to automate this process by tracking several text data streams and automatically sending out alerts when market-moving events occur.

Understanding Document Tone

Measuring document tone is one of the most popular applications of NLP in the finance field. Measuring document tone is simply that the NLP algorithm reads the document and assigns a score known as sentiment analysis. Xing and his friends emphasize that “Some recent research indicates that a combination of subjective sentiment and objective event facts would take advantage of each other and produce a better forecasting result.” Sentiment analysis is another branch of NLP that can extract analytical meaning from text well enough to assess its behavior or opinion. It is an excellent tool for looking for discrepancies and anomalies in unstructured content about a business.

Modeling Document Topics

The goal of subject modeling is to find the abstract “topics” that appear in several documents. It is a text-mining tool that is often used to find hidden semantic relationships in a text body. NLP systems in finance sometimes need to automatically extract a document’s subject structure to be efficient.

Detecting Subtle Change

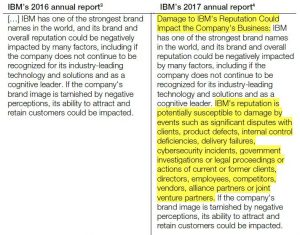

In NLP studies, the topic of subtlety is very common. The information found in text documents can be very clear to the human eye, but it can also be buried. NLP may be used to measure textual change, such as comparing the same materials over time and detecting slight differences.

In IBM’s annual report 2016, for example, a snippet about the company’s business risks was included under a risk factor called “Failure of Innovation Initiatives.” IBM agreed to classify it as a separate risk factor named “Damage to IBM’s Reputation” in the coming year’s annual report and specifically identified eight different categories of example sources of reputation risk.

A human’s ability to detect those subtle changes can be difficult and time-consuming. Yet these modifications are clear to a machine: NLP algorithm will automatically check millions of documents and detect the added, deleted, or modified risk factors, classify them by subject, and even verify which other businesses have changed their risk factors in ways similar.

Source

Levin, S. (2018, May 2). Facebook announces dating app focused on “meaningful relationships.” The Guardian. https://www.theguardian.com/technology/2018/may/01/facebook-dating-app-mark-zuckerberg-f8-conference

Xing, F. Z., Cambria, E., & Welsch, R. E. (2017). Natural language based financial forecasting: a survey. Artificial Intelligence Review, 50(1), 49–73. https://doi.org/10.1007/s10462-017-9588-9